Most of us worry about finances at some point, with 72% of Americans worrying about money at least some of the time. There’s a significant difference between the awareness of money troubles and serious mental health problems caused by thinking about or dealing with money.

Keep reading to learn more about how money can affect mental health, the psychological reasons for overspending, and how to tackle financial worries with actionable tips.

Can Financial Stress Cause Mental Illness?

Money is a common cause of stress and anxiety. It may come as no surprise that money and mental health are linked, with money being the main worry of Americans. If you struggle to pay for your essentials like groceries and electricity, this could seriously impact your mental health, causing increased anxiety and problems coping with stress.

Additionally, if you already suffer from a diagnosed mental illness, financial stress can have a cyclical effect. Symptoms may get worse, affecting your ability to go to work and keep up with your bills, which makes your symptoms even worse, creating a harmful cycle.

If your mental illness causes manic episodes, you may find you overspend on impulse purchases, which then contributes to debt. With debt comes even higher levels of anxious feelings, dread when letters arrive in your mailbox, and avoiding the phone when it rings.

Other ways to cope may be turning to alcohol, gambling, or substances, which have a detrimental effect on both your physical and mental well-being.

The Psychological Reasons for Overspending

There are several reasons you might reach for your credit card and splurge, even when you don’t have the means. Here are some common psychological reasons for overspending that can lead to financial worries.

A Big Change or Loss

You just received some bad news — perhaps you unexpectedly lost your job or you have to move to another state. It’s tempting to spend money as a form of escapism because of the surge in “feel good” hormones that buying something can give you. However, that feeling is short-lived and could lead to long-term debt, exacerbating your anxiety. Spending doesn’t fix the problem at hand and only serves as a temporary distraction.

Instant Gratification

If you’re not satisfied with your life, you might find overspending helps you feel better in the moment. Then once that feeling wears off, you buy something else to feel that rush again. Before you know it, you have an unhealthy habit of overspending to hide your emotions.

Social Media Pressure

Social media can contribute to feeling unsatisfied with life. When your feed is full of people showing off a new phone or a better wardrobe than you, it might feel like it’s worth putting yourself into debt to keep up appearances. In reality, the financial stress and mental health problems this can cause aren’t worth looking good to strangers.

Scarcity

If you’re constantly buying things you don’t need because they were on sale, you could have a scarcity mindset. When there’s a sense of urgency like a limited-time offer, you might feel pressured to buy it because you don’t want to miss out. Often you might not even need the item in the first place, which creates a spending habit that puts you in the red.

What Is Financial Anxiety?

Financial anxiety is debilitating and can affect all areas of your life, not just your ability to pay your bills. Your social life, job, home life, physical health, and confidence can all feel the effects of financial anxiety.

Symptoms of financial anxiety can include:

- Avoiding mail in your mailbox

- Ignoring phone calls

- Getting angry with loved ones or your boss

- Insomnia

- Overspending

- Hoarding

- Being excessively frugal

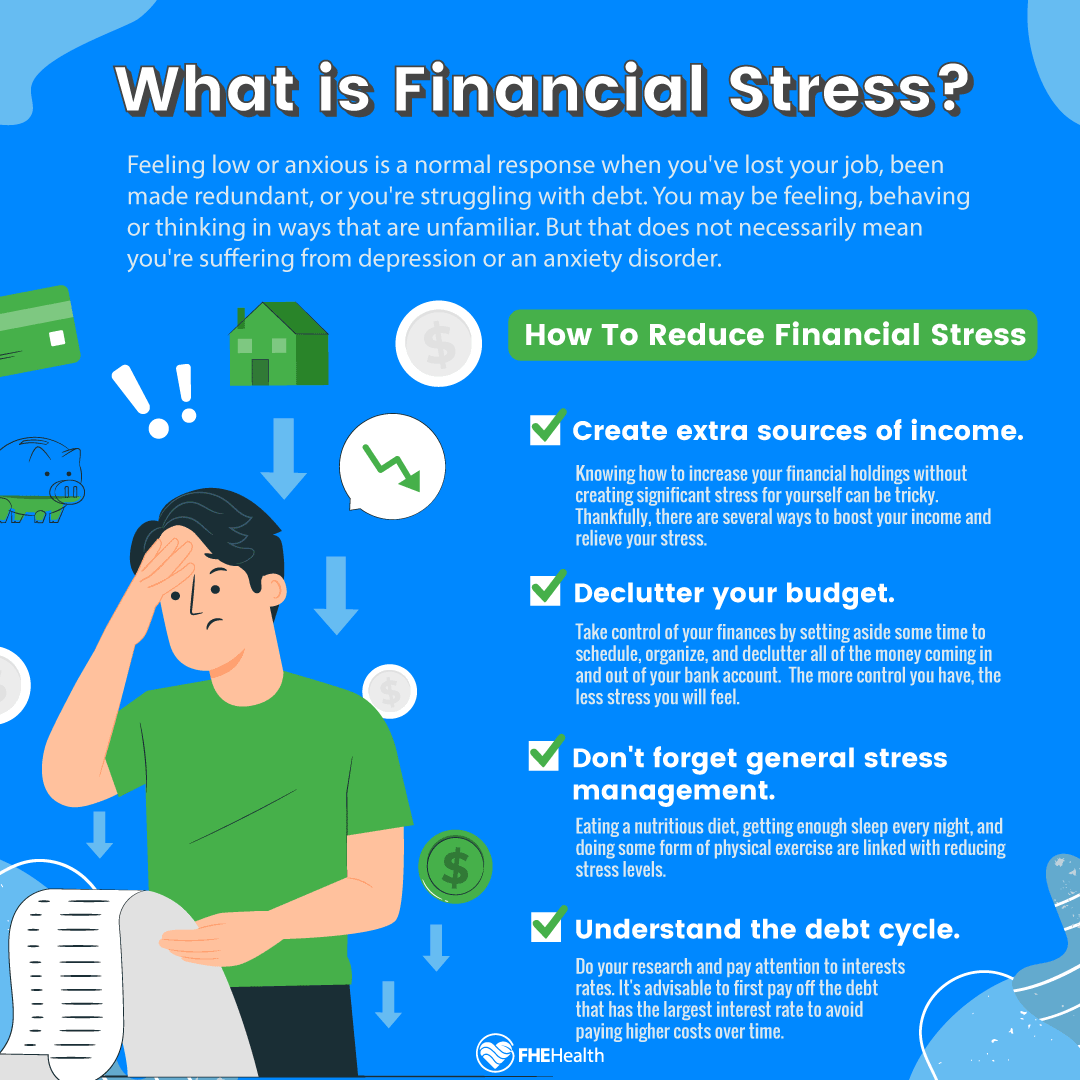

How Can You Resolve Financial Stress?

Many of the issues causing money depression and anxiety are avoidable, but it requires some changes to your lifestyle and a conscious effort to shift your mindset.

Talk to Someone You Trust

Money problems can feel embarrassing or scary to talk about, but it’s important to share how you feel with someone you trust. This might be your spouse, your sibling or a close friend who won’t judge you. Getting your feelings across can begin the journey of addressing your problems.

Delete Unhelpful Apps

If you find yourself mindlessly scrolling store apps, delete them off your phone and tablet. Remove all bookmarked shopping sites from your browser. And turn off any push notifications you receive about deals and offers — if it’s out of sight, you won’t feel the urge to spend uncontrollably.

Make a Budget

Erratic spending without a budget can lead to spending more than you can afford. Make a budget and stick to it by writing it down or using a budgeting app to help you. Allocate a certain amount of your income to things like food and luxuries, and challenge yourself to not go over budget. You’ll be more aware of what you spend.

Make a List of Free Things That Bring You Joy

They say money can’t buy you happiness — and while having enough money to cover the basics does help minimize anxious feelings, there are ways you can combat overspending for free. Walking your dog, geocaching, gardening and free attractions in your local area are enriching to your soul, and you don’t have to spend a dime.

Unfollow Social Media Accounts

Some accounts you follow on Instagram or TikTok share post after post of their seemingly perfect life, which can make you feel inferior. Or influencers may constantly push the latest hot product onto your feed. If you feel social media is making you spend money to look or feel a certain way, unfollow those accounts.

Explore Earning Opportunities

If after budgeting you still don’t have enough income to pay for your essentials to live, then it might be worth exploring additional ways to supplement your income. Whether that’s a side project or finding a better-paying job, it could be worth exploring your options to improve your financial situation.

You Don’t Have to Struggle With Money Alone

Dr. Beau A. Nelson, DBH, LCSW, Chief Clinical Officer at FHE Health instructs that “there is a definite link between stress and compensatory behaviors like overeating, sleeping, drug use, compulsive behaviors, escaping, or overspending to feel better and to distract ourselves from our difficulties. Being aware and making healthy changes to your choices, lifestyle, and spending habits can be a great start on the road to a better relationship with money.” If you feel that isn’t enough and you’re still struggling to cope most days, help is at hand, reach out to a professional or look for a support group for additional assistance.