FHE Health accepts most forms of Humana health insurance. If Humana is your insurance provider, let our team can verify whether it covers our services under your plan. Although we don’t guarantee coverage, we can check with the provider in a few minutes and without any cost or obligation to you.

If we cannot accept your Humana insurance, we will happily refer you to another service.

Who Has Humana Health Insurance?

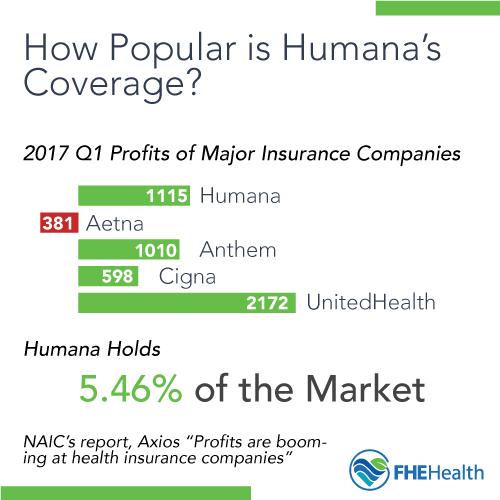

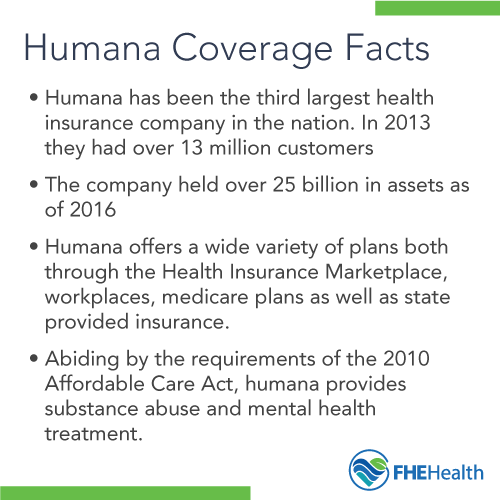

Humana is one of the largest providers of health insurance in the United States. The company offers plans to individuals, often through the Healthcare Marketplace, and through employers. With over 350,000 medical providers, 50,000 pharmacies and 3,000 hospitals in the network, Humana covers the health insurance needs of many people.

Humana is one of the largest providers of health insurance in the United States. The company offers plans to individuals, often through the Healthcare Marketplace, and through employers. With over 350,000 medical providers, 50,000 pharmacies and 3,000 hospitals in the network, Humana covers the health insurance needs of many people.

If you have Humana insurance, you can call us for free and confidential insurance verification or visit the Humana medical insurance website to verify your plan and coverage. You can also use it to learn more about available providers in your network.

With 1,549,638 discharges for clients from drug and alcohol treatment facilities in 2015, according to data from the Substance Abuse and Mental Health Services Administration, Humana recognizes the need for mental health care.

How Can Humana Health Insurance Help You?

If you have a Humana medical policy, you can obtain coverage for most types of drug and alcohol rehabilitation from substance use disorders, including:

- Illicit drug use

- Alcohol dependency

- Prescription drug use

- Mental health disorders

- Undiagnosed mental health conditions

Humana insurance covers other more general medical needs as well. If you have a disease or injury as a result of your drug or alcohol use, Humana can provide financial coverage for medical treatment.

What Are Insurance Plans Obligated Offer for Drug and Alcohol Rehabilitation?

Under the Patient Protection and Affordable Care Act, a law put into place in March of 2010, health insurance companies must provide coverage for drug and alcohol rehabilitation in the same way that they provide care for other diseases, such as heart disease or cancer. They cannot discriminate in any way against those with an addiction.

Specifically, these health care providers must provide behavioral health care and mental health services to those who need it. If you have a Humana insurance policy, it must provide care at the same level as it would for other injuries or illnesses. However, the amount of coverage and the availability of protection varies under the numerous plans offered by the company.

What Types of Humana Health Insurance Are Available for Your Care?

You may have to obtain a referral from your primary care physician prior to receiving care from a specialist. You may still be able to get care from a provider outside of the network. If you do so, there may be less coverage for the care, or the policy may not provide any coverage.

Some Humana health insurance policies are PPO, or preferred provider organization, plans. In these types of plans, you have more flexibility in choosing a care provider or a hospital for your needs.

PPO policies pay for more non-networked providers as well. They still may not provide as much coverage as an in-network provider would receive.

Our team at FHE Health can help you determine whether you are a member of an HMO or PPO and what level of care is available to you.

Humana has several policy options, and you may have one of the most common policies.

Humana Portrait Insurance

If you work with a large corporation that provides health insurance, you may have a Humana Portrait insurance plan. This plan gives you access to a large selection of in-network providers.

Typically, this policy pays 80 percent of the cost associated with the services you receive, and you are responsible for the remaining 20 percent. This policy has deductibles, which can be as high as $2,500 per person.

Monogram Insurance Plans

Humana Monogram plans are a common option for those who purchase through the Healthcare Marketplace. Monogram plans are a lower-cost option and tend to have a high deductible requirement, in some cases, as high as $7,500. Monogram is a more affordable option but still provides financial coverage for preventative care and behavioral health services.

Humana Autograph Health Insurance

Another option is the more versatile Humana Autograph health insurance plan. What makes it different is that clients can adjust and customize the plan to meet their specific needs.

You can choose how often you visit your doctor or how much coverage you need for prescriptions. This type of coverage is ideal for those who want a policy with more coverage for specific services, such as mental health care.

Humana HSA

Humana also offers health savings accounts, which are managed plans with tax-savings benefits. You can use the funds from your HSA to pay for your rehabilitation needs. The Autograph plan plus HSA is Humana’s way of combining these products for you.

Humana Medicare

If you are on Medicare, Humana Medicare is available. There are several options, including Choice PPO, Gold Plus HMO and Gold Choice. These plans can help to get additional coverage beyond what basic Medicare offers.

What Levels of Care Are Available Through Humana Health Insurance?

On-Site Psych Care

When you ask, “Does Humana cover rehab,” realize this just the beginning. Depending on your plan, you may need a referral from your physician to receive a formal psychological evaluation for care.

Other plans allow the doctors and therapists at FHE Health to provide this evaluation for you initially. It is always conducted upon your arrival.

Detox Solutions

If you are chemically dependent, your health insurance policy may cover the costs of detox. This is an inpatient service in which doctors monitor you while you work through the withdrawal process.

They can offer medications to assist with pain and provide supportive services for any medical emergencies that occur. Your Humana insurance provides detox coverage for those who receive a diagnosis of dependency from a doctor.

Inpatient Care

Many people who enter detox programs or are facing severe dependency need residential or inpatient care. Humana insurance plans range in terms of how long this service is available.

It may be as little as 14 days or as much as 90 days. Inpatient care is available to those who may not have a safe environment for detox at home or may be medically or mentally unstable in their current condition.

Outpatient Treatment

Humana plans often provide outpatient care for those who have a stable home environment. It may also offer this service to those who are mentally stable and able to care for themselves.

Outpatient care may include medically assisted treatments along with routine counseling sessions. Some people may qualify for intensive outpatient treatment, which may be a good option for those with a need for more frequent appointments.

Getting Help When You Have Humana Health Insurance

When you contact FHE Health, our team gathers information about you and verifies your identity so we can check your insurance coverage. This process involves us determining if you have coverage as well as the amount of coverage available to you through your plan.

It’s important to know that we never put your employment at risk. When we contact you about your Humana insurance plan, we do so in a completely confidential manner. Your employer will not know what type of care you are seeking.

Our team provides fast, reliable, no-obligation Humana health care insurance verifications. Call us for an immediate consultation with our admissions team.