FHE Health is proud to accept Blue Cross Blue Shield health insurance. We cannot guarantee that every type of Blue Cross will cover the services you need at FHE Health, but our team is here to help you. When you call us, we provide a confidential and free verification of your benefits for you. If your coverage isn’t valid for our facility, we’ll provide you with a referral to another facility that does accept it.

Who Has Anthem Blue Cross?

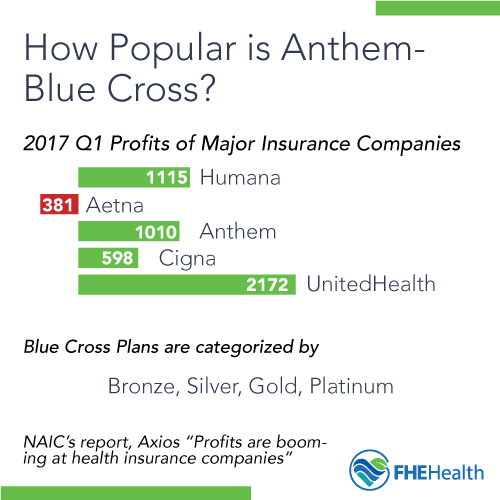

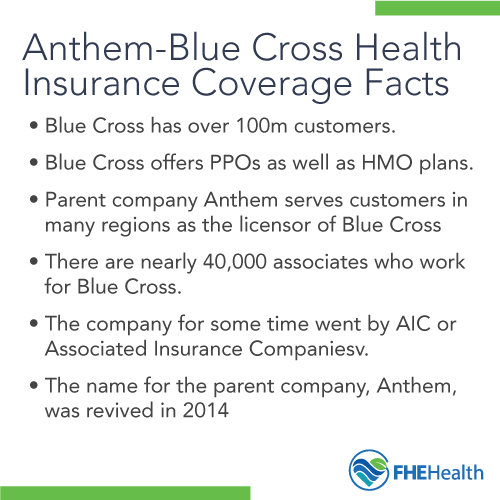

Blue Cross Blue Shield insurance is one of the largest providers of health insurance in the U.S. The company states it covers over 100 million people with plans available across numerous states. It represents 36 local and independently owned companies, operated under various plan names.

This type of health insurance is available to individuals through the Healthcare Marketplace. However, many people obtain coverage through their employer. Employer-based programs are available through both for-profit and nonprofit organizations.

What Can Blue Cross Help You With?

Health insurance from Blue Cross can help you with a number of different needs. Many plans exist, each with different levels of coverage for addiction treatment.

This insurance provider offers several types of coverage plans. Health Maintenance Organizations, or HMOs, require you to remain in-network when you get care. This means you need to choose from the available providers in your network to receive financial compensation for your coverage needs. Most HMOs also require a referral from your primary doctor to see a specialist, like those available through addiction rehab services.

Blue Cross also offers Preferred Provider Organizations or PPO. This type of coverage provides a bit more flexibility when choosing your provider, though you still may pay more for your out-of-network choices. These plans cover your specialists (usually with a requirement for a referral) even if they are not in the network.

Take a look at your coverage plan. You may notice tiers, which determine how much coverage you have. You or your employer chose this level of protection when you obtained the plan. There are numerous tiers including the following.

Bronze Coverage

These plans tend to have the highest deductibles, or funds you must pay first before medical coverage is provided. Premiums on this type of plan tend to be the lowest. Coverage amounts after meeting your deductible can range but are typically around 60 percent of every bill.

Silver Coverage

Anthem Blue Cross Silver coverage offers a slightly higher price point but tends to offer more payment for your medical bills after your deductible is met. This policy tends to offer coverage of 70 percent of your bills. The deductible may still be high, though.

Gold Coverage

The next level up provides the same basic benefits. Your deductible will be slightly more affordable. However, your premiums are likely to be significantly higher. You will get up to 80 percent of your medical bills paid after you meet your deductible. This plan is one of the company’s more commonly used.

Platinum Coverage

The highest tier available, the Platinum plan gives you the highest premium cost, but it provides the lowest deductible. Once you meet that deductible, the plan covers 90 percent of the remaining medical debt.

In addition to this, coverage may differ for the type of service you need. Most plans have a co-pay. You will also find partial hospitalization and hospital benefits differ from one tier to the next.

What Are Insurance Plans Obligated to Help You With?

It’s always best to speak to your insurance company to inquire about coverage amounts and limits. When you contact your insurer, that agency cannot disclose any information to your employer or other people. Your privacy remains protected.

Levels of Care Available Through Blue Cross Coverage

With Blue Cross Blue Shield insurance covering some of your care, you may be wondering what to expect about the types of drug and alcohol treatment or mental health disorder treatment available to you. Take a look at a few of the most common services necessary.

Drug and Alcohol Detox Coverage from Blue Cross

Detoxification is a requirement in some situations. If an individual is facing a life-threatening situation, such as an overdose, most plans will provide coverage for emergency medical help. The patient may immediately be transferred to detox after being stabilized.

Patients who are not at risk of an overdose but have a debilitating addiction and are at high risk at home for drug use may also qualify for a medically supervised detox program. Your doctor will provide a full physical to determine the level of care you need. If detox is beneficial, your insurer will likely cover it due to the specialist’s recommendation.

If you are seeking help for mental health disorders, Blue Cross insurance may cover the cost for emergency medical care to stabilize your health. This is dependent on the individual circumstances of your case.

Medication-Assisted Treatment Coverage from Blue Cross

Many Blue Cross plans cover the medication-assisted treatment. However, your provider will verify this before using this treatment method. This may include treatment using products such as Suboxone®, Revia or Methadone. Your doctor will need to provide information about this need to the insurance company to get its use approved.

Inpatient Rehabilitation Coverage from Blue Cross

Some Blue Cross Blue Shield policies may require authorization for inpatient treatment after a doctor consult. The stay is likely to have a limitation on the number of days you can remain in care. Most inpatient rehab programs offer services ranging from one week up to 90 days. Your doctor will recommend care based on your specific needs.

Outpatient Rehabilitation Coverage from Blue Cross

Outpatient rehabilitation, including intensive outpatient rehabilitation, may be available to you with coverage. Blue Cross plans tend to offer approval for outpatient rehabilitation at a faster rate than inpatient care. Yet, again, your doctor will need to discuss why it is important for you to obtain care. Your doctor also will recommend the type of care you need, such as how many hours per day or week you need therapy.

Outpatient rehabilitation coverage may be available for a set number of days. Plans range from several weeks to a year in some cases.

Transitional Living Coverage from Blue Cross

It is not as common for Blue Cross patients to receive financial support for transitional living or sober homes. This type of care tends to have limitations across all insurers. Nevertheless, if it benefits you and your long-term well-being, your doctor can recommend it. Your insurer will then deny or approve the coverage for you.

Getting Help When You Have Blue Cross Insurance

Insurance is a complicated matter, but you don’t have to make those decisions on your own. Rather, contact our team at FHE Health. We will provide you with a full verification of your insurance coverage. This is done in a confidential manner when you call us. We are able to verify your coverage without speaking to your employer. No one will know you are inquiring about this coverage.

If you have Anthem Blue Cross Blue Shield coverage, call our caring team of administrators at (833) 596-3502. We can answer your questions and verify your coverage for you. Our team is available 24 hours a day to answer your questions and provide immediate assistance for drug and alcohol rehab.