Estate planning is a complicated process, even for those with modest assets. The question of how to allocate assets, protect assets and provide for children and grandchildren is a deeply personal situation and will vary greatly from one family to another.

Standard steps, like drafting wills, are recommended for everyone, but more specific situations may warrant unique avenues for asset protection. If you are experiencing substance abuse challenges or want to set up guidelines and restrictions for money passed to your beneficiaries in case your child experiences a substance use disorder, a substance abuse trust can be a good way to ensure money is used in the right ways.

How Does a Substance Abuse Trust Work?

Addiction is a disease, not a choice. It affects all aspects of life, from relationships to job stability. And, unfortunately, this often means an unwise use of money. When an addiction to drugs or alcohol takes over, it’s not uncommon for affected individuals to begin pulling from savings, taking out loans or draining retirement accounts to feed a habit. These actions are often deeply regretted in recovery, but at this point, the damage is done. There’s no way to undo the past or reclaim assets willingly handled to a liquor store clerk or the local drug dealer.

Addiction is a disease, not a choice. It affects all aspects of life, from relationships to job stability. And, unfortunately, this often means an unwise use of money. When an addiction to drugs or alcohol takes over, it’s not uncommon for affected individuals to begin pulling from savings, taking out loans or draining retirement accounts to feed a habit. These actions are often deeply regretted in recovery, but at this point, the damage is done. There’s no way to undo the past or reclaim assets willingly handled to a liquor store clerk or the local drug dealer.

A substance abuse trust is a form of trust that intends to protect against reckless behavior or poor decision-making when under the influence of drugs or alcohol. These trusts can be established to prevent your own inappropriate choices when under the influence or in a cycle of abuse or can be set up to keep your beneficiaries from doing the same. Known as a special interest trust, this unique kind of legal construct can be a huge benefit in preventing serious destruction and loss of resources when stuck in a dangerous spiral.

Substance abuse trusts, like all trusts, need to be established with a specific set of rules and policies in place. If preventing the loss of assets due to substance abuse or ensuring payment for treatment is the objective, a legal professional can help put these policies into place.

When Is a Substance Abuse Trust Necessary?

The prevalence of the opioid epidemic is no secret, and no place in the country is unaffected. Overdose rates have been steadily on the rise for years, and even the heightened presence of Narcan and strides in harm reduction strategies have done little to stop the spread. In 2016, 63,632 Americans lost their lives to drug overdoses of all kinds.

Many of those who have found themselves in active addiction never expected to be there, particularly those who started using via legal prescriptions for pain management after an accident or injury. While you never want to expect yourself or your children to end up with an addiction to drugs or alcohol, things happen. When there are significant assets at stake, protection should always be a priority, even against unlikely situations.

If you have amassed significant wealth or even modest wealth you would like to see continue, a substance abuse trust may be a good idea. This is particularly true if you, your spouse, or your children have a history of abuse or show a propensity for addiction or reckless behavior.

Setting Provisions for a Substance Abuse Trust

Establishing a trust isn’t necessarily a difficult process, but the legal framework is predicated on clear, enforceable instructions. As addiction isn’t always a quantifiable situation, this can make putting provisions in place harder than it sounds.

Establishing a trust isn’t necessarily a difficult process, but the legal framework is predicated on clear, enforceable instructions. As addiction isn’t always a quantifiable situation, this can make putting provisions in place harder than it sounds.

Trusts aren’t one-size-fits-all, and there are some base-level determinations that must be made before any stipulations can be put in place. First, you’ll need to decide whether you want your trust to be revocable or irrevocable.

A revocable trust, as the name implies, can be altered or changed at any time by the trust owner. This kind of trust is also known as living trust. An irrevocable trust, on the other hand, cannot be changed once it has been established. Once papers are signed, the benefactor relinquishes all rights to the assets in the trust, and there’s generally no way to reverse this. A revocable trust is a better choice for a younger parent to create for a child or for an individual to create to protect himself, while an irrevocable trust functions better as a vessel of an estate. However, this choice will be largely a personal decision based on individual preferences and needs.

You will also need to determine whether you want this trust to be active or passive. With a passive trust, the trustee’s sole job is to manage assets following the trust bylaws. An active trust, however, is managed by a trustee in a way that allows a certain level of discretion. For substance abuse trusts, an active management style is generally preferred. In these cases, a trustee can determine the presence of addiction and make judgments about asset distribution based on the terms of the trust.

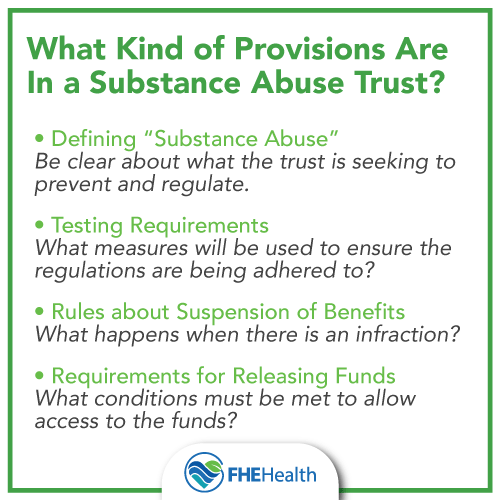

It is important to note that substance abuse clauses applicable to a trust can’t exactly be automatic or self-triggering. There is always going to be some level of discretion involved on the part of the trustee, and finding the line isn’t always clear. As such, some attorneys advocate the creation of specific provisions that can be followed to guide the process. These include:

- A definition of substance abuse, like substance of choice, duration of use, or frequency of use

- Testing requirements to verify assumptions regarding substance use or sobriety

- Suspension of benefits, like mandatory or discretionary distributions, based on results of testing or observation of substance use

- The kind of treatment programs that qualify for coverage, like rehabilitation centers that provide a full spectrum of care vs. a short-term detox

Trustee selection is also very important. This person will essentially be the decision-maker, dictating how and when provisions apply, and that’s not always an easy burden to bear. Choosing the right trustee may mean working with someone with education related to addiction, be it a bank, a legal professional, or another family member.

The Value in Protecting Assets

Some friends and family members of those in active addiction believe that financial resources are the best way to provide support. In some ways, this can be true — it’s hard to keep a steady job without a house or a car, so help with rent or car payments can be of value — but under most circumstances, giving a substance user access to money will only worsen the situation.

Some friends and family members of those in active addiction believe that financial resources are the best way to provide support. In some ways, this can be true — it’s hard to keep a steady job without a house or a car, so help with rent or car payments can be of value — but under most circumstances, giving a substance user access to money will only worsen the situation.

When money is withheld in the case of addiction, rock bottom may be a whole lot closer. Once savings and any regular cash flows are extinguished, users may find themselves facing challenging circumstances like homelessness or a life of crime to fund habits. These kinds of steps are far more difficult, both emotionally and ethically than using drugs in a nice home with a nice car. Thus, withholding assets can accelerate the process of hitting rock bottom and, subsequently, the decision to get clean.

Most substance abuse trusts are designed to cut off an individual until the choice to get treatment is made. In this case, support kicks back in with the enrollment in a rehabilitation program, immediately eradicating financial stressors and guaranteeing that funding is there to complete a course of care, no matter how long it takes.

In order to prevent abuse of a trust’s policies by entering rehabilitation and going through the motions, an actively managed trust with a designated trustee will generally make funds available in small amounts to encourage a clean lifestyle post-treatment. Any sign of continued use can result in another revocation of support. Alternatively, a trustee can allocate money to be used for things like rent or a car to prevent inappropriate use of cash.

Promoting a Clean Lifestyle With a Trust

It’s never easy to feel as if you’re putting restrictions on yourself or a loved one, but in some cases, providing boundaries is the kindest thing you can do. With proper planning and foresight, it can be possible to encourage the responsible use of assets and the use of rehabilitation programs to address addiction.

If you or someone you love is facing a substance use disorder, FHE Health can offer a full continuum of care, from detox to alumni programming, to encourage long-lasting sobriety. Please contact us today to learn more about how our rehabilitation opportunities can make a difference for you.