This article has been reviewed for accuracy by our peer review team which includes clinicians and medical professionals. Learn more about our peer review process.

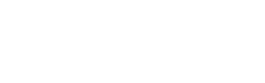

The following fact may come as a surprise: “75 percent of people with addiction survive and go on to live full lives, especially if they get good treatment.” That’s according to NPR, in a January 2022 report on research from the CDC and the National Institute on Drug Abuse.)

In other words, like other mental and physical conditions, substance use disorders can benefit from medical care—and treatment has saved many lives. “Inpatient rehab,” consisting of detox and intensive group and individual therapies in a sober residential environment, is a major predictor of successful, long-term recovery.

FAQs Like “Is Rehab Tax-Deductible?”

Still, worries about how to afford rehab can delay and even prevent access to this essential form of care. That’s why we’ve compiled the below list of frequently asked questions, along with expert answers from FHE Health Chief Financial Officer Todd R. Branstetter. In his role overseeing FHE Health’s finance department, Branstetter routinely handles questions related to patient billing and insurance deductibles, among other issues. Branstetter, who has served FHE Health as CFO since 2018, has more than 25 years of experience providing tax advice to small businesses, along with another 12 years as a CFO in the treatment industry.

Still, worries about how to afford rehab can delay and even prevent access to this essential form of care. That’s why we’ve compiled the below list of frequently asked questions, along with expert answers from FHE Health Chief Financial Officer Todd R. Branstetter. In his role overseeing FHE Health’s finance department, Branstetter routinely handles questions related to patient billing and insurance deductibles, among other issues. Branstetter, who has served FHE Health as CFO since 2018, has more than 25 years of experience providing tax advice to small businesses, along with another 12 years as a CFO in the treatment industry.

Tax-Deductible Drug Rehab: “Can You Write Therapy Off on Your Tax Return?”

“Yes, absolutely,” Branstetter said. Rehab, including inpatient therapy, “is a medical expense, so if you’re allowed to claim medical expenses and itemize them on your tax return, you can include whatever out-of-pocket expenses—including travel to rehab, if you paid any of these expenses as well.” (“You do have to itemize your deductions to be able to deduct the cost of rehab on your tax return, though,” Branstetter clarified.)

Suggestions for Paying for Rehab?

“There are different ways you can pay for rehab,” Branstetter said. “You can pay directly with cash upfront or with a credit card. Some people have flexible spending accounts through their job that they can use to help pay for some of the out-of-pocket expenses.”

How does a flexible spending account work? “You can earmark out of your paycheck a certain amount that goes into this flexible spending account. The idea is that this money is for medical expenses, so whatever you put into the account is pre-tax and isn’t included in your taxable income.”

Branstetter explained how it works: “If you’ve got a $1000 insurance deductible for the year, you can put money into your flexible spending account to pay for that deductible and then you’ll get that as a tax deduction, as in $1000 that’s not taxed because it reduces your W-2 taxable wages).”

Of course, not every employer offers a flexible savings account. Those who need to finance treatment can also take out a home equity line of credit, Branstetter said.

How Health Insurance May Offset the Costs

Many insurance plans cover the cost of rehab. This means that if your insurance offers full or nearly full coverage, your financial responsibility mostly “comes down to your copayments and deductible.” One caveat here, according to Branstetter: “You could have insurance coverage with a small, out-of-pocket deductible. If you have a $10,000 deductible, then you could be paying quite a lot out of pocket.”

What Treatments Does Insurance Cover?

Thanks to the 2008 Mental Health Parity and Addiction Equity Law, it is no longer possible for insurance companies to claim that “a stomach ailment should be covered but a behavioral health need should not be.” While that may be progress, Branstetter was quick to note that “still, some insurance companies manage behavioral health treatment very closely,” and “a lot of times we have to fight to get them to cover the care that’s needed.”

As for what treatments are covered by insurance, they typically include:

- The initial physical and psychiatric evaluation

- A medically supervised detox (although the length covered can differ with insurance plans)

- Residential treatment, which includes all therapies, sessions, and groups

- Medical and psychiatric appointments that may be part of an outpatient or aftercare program

What to Know About What You’re Paying for in a Rehab Program

The important thing to remember is the “clinical question: You want to make sure you’re getting your needs met.” The way to do that, according to Branstetter? “Look for the treatment provider that is offering as many services as possible to meet patient needs, so that patients have the best chances of succeeding in recovery … massage, yoga, trauma therapy … The key is to look for a provider that has multiple services.”

The important thing to remember is the “clinical question: You want to make sure you’re getting your needs met.” The way to do that, according to Branstetter? “Look for the treatment provider that is offering as many services as possible to meet patient needs, so that patients have the best chances of succeeding in recovery … massage, yoga, trauma therapy … The key is to look for a provider that has multiple services.”

Another related and important consideration is whether a prospective rehab program is treating a drug or alcohol problem with “integrated care.” By that Branstetter meant a “holistic” approach “integrating behavioral health alongside other co-occurring medical problems.” For example, a patient might have liver problems because of alcohol, or they might have diabetes. With “medically integrated care, we’re treating all the comorbidities,” Branstetter said.

More Advice for How to Get the Most Value Out of a Rehab Program?

Any rehab program is going to cost money and could be expensive. Families naturally should want to know how to get the most value in return. After all, a quality rehab program will be a smart life investment rather than a waste of money.

Branstetter offered this parting recommendation for how to find a trusted treatment that is worth your investment: “You really need to look at what services you’ll be receiving for your dollars and ask, ‘What kind of programs do you have?’ You should be getting the most extensive treatment, integrated care, and lots of different services for your dollars.” This is especially true, Branstetter added, “If I’m comparing one provider to another and the treatment is covered by insurance, I’m paying the same out-of-pocket amount for these programs, so I want to choose the one with the most value.”

Don’t let worries about the cost of rehab keep you from experiencing life after addiction. For more information about your financial options, reach out to FHE Health today.